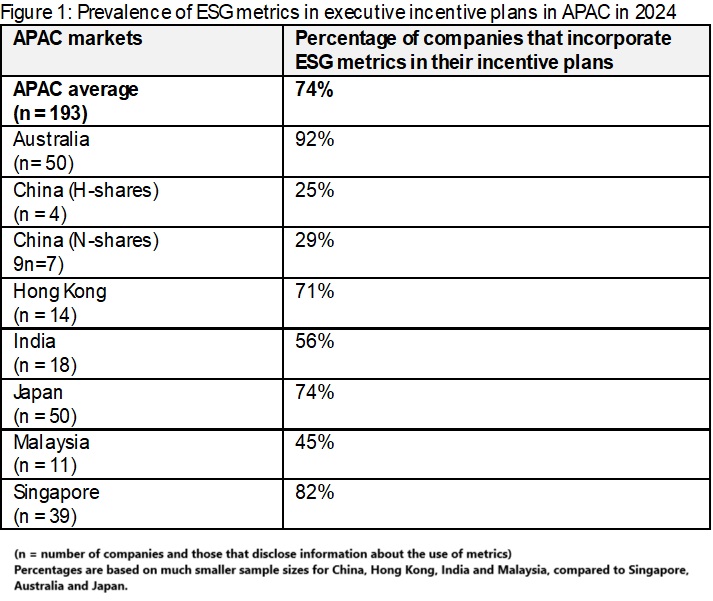

SINGAPORE, January 14, 2025 – Nearly three-quarters (74%) of the top 50 listed companies in Asia-Pacific (APAC) markets have integrated Environmental, Social, and Governance (ESG) metrics into their executive pay programmes, according to a recent study by global advisory firm WTW (NASDAQ: WTW). This marks a steady rise in the adoption of ESG-linked incentives aimed at fostering sustainable business practices.

The report analysed disclosures from 193 companies across the APAC region, highlighting notable industry trends. The energy, materials, and financial sectors emerged as the leaders in integrating ESG metrics. Australia (92%), Singapore (82%), and Japan (74%) had the highest adoption rates, while markets such as China and Malaysia trailed behind at 25% and 45% respectively.

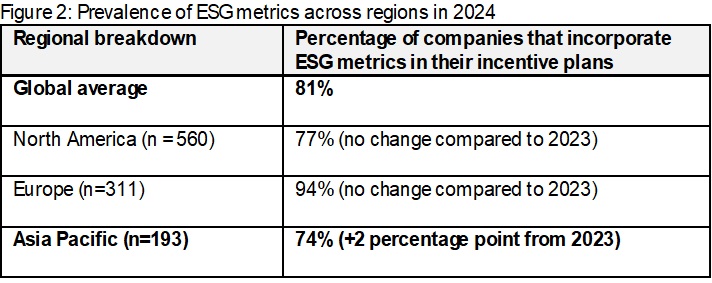

Globally, APAC lags slightly behind Europe (94%) and North America (77%) in ESG metric adoption. However, APAC showed a modest 2% year-on-year increase, indicating a growing recognition of sustainability measures in corporate governance.

Short-Term Incentives Dominate ESG Usage

The majority (64%) of APAC companies apply ESG metrics in short-term incentive (STI) plans, reflecting a preference for immediate performance targets. Only 30% incorporate ESG measures into long-term incentive (LTI) plans, a figure significantly lower than European companies that prioritise long-term carbon emission goals.

Social metrics, such as diversity and inclusion, remain the most prevalent in APAC executive compensation schemes, adopted by 62% of companies — an 8% increase from the previous year. Environmental measures, including greenhouse gas (GHG) or carbon emission targets, featured in only 30% of cases, lagging far behind Europe’s 85%.

Regional Influences on ESG Adoption

“The level of disclosure requirements and institutional investor expectations vary across markets, impacting the prevalence of ESG metrics in APAC,” said Shai Ganu, Managing Director and Global Practice Leader, Executive Compensation and Board Advisory at WTW.

He noted that geopolitical shifts could temper the adoption of climate and diversity measures, particularly in North America. However, he remained optimistic about the region’s future, stating, “Asian companies will do well by continuing to drive alignment between ESG strategy and executive incentives.”

Study Overview

The study analysed public disclosures from 1,230 companies globally, including 320 from Europe, 560 from North America, and 193 from APAC. The research spanned multiple sectors, including energy, financial services, healthcare, IT, and industrials, offering a comprehensive view of evolving trends in ESG-linked executive compensation.